Viva Leisure (VVA): fit for growth

- Feb 28, 2020

- 2 min read

On 26/02/2020, Viva Leisure (ASX:VVA) reported their half year results. The result was solid and in line with our estimates and broker consensus numbers. On the day of the result the shares traded down 17% from their prior closing price. The chart below shows the intraday trading range, with the share price fluctuating between $2.2 to $2.6 on low volumes. A lot of the selling was retail selling with the market wanting massive upgrades. Viva has a good growth profile and trades on an attractive multiple.

This large intraday movement illustrates that the market is being influenced by news headlines. This experience wasn’t just confined to VVA, many companies saw the same price action. Afterpay was down initially after their result was released and ended up on the day.

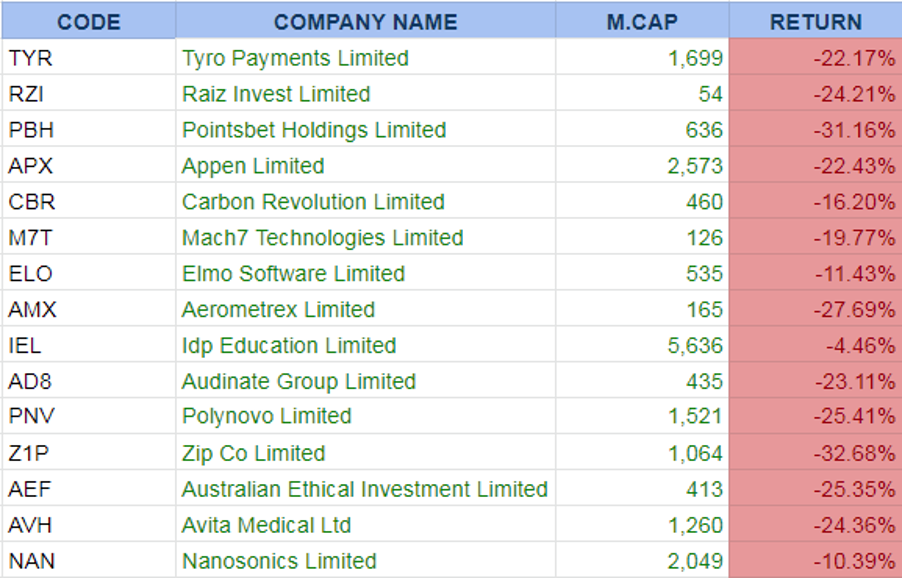

Small Cap growth stocks returns since 12 February 2020

As investors with a fundamental approach to investing, the noise and fluctuations prove annoying and distracting. This is where it pays to remember your core principles, being that you are buying businesses. You need to focus on the operational performance of the businesses you own.

The summary of the result is as below. In addition to that, the company grew its number of members by both acquisitions and organically. We were happy with the result because the company shows a wide range of growth opportunities:

The utilisation rate is now down from 75.3% to 71% after the acquisition. We expect this will rise to 78% in the long run after upgrading the fit-out.

The EBITDA margin is now at 24.4% including acquisitions. We expect this will rise to 28% in the next three years after system integration, head office synergies and wage saving.

Hiit republic boutique brand is a huge success, generating over $3.6 mil of annualised revenue with less than 12 months since the first location opened. We expect the clubs can continue the high margin (50% in EBITDA margin) in the future.

If you have further questions on our approach to Viva Leisure, please contact kenny@glennon.com.au.

Comments